USDT Depeg Concerns Arise Amid Curve Pool Imbalance, Tether CTO Cites FUD

Join Our Telegram channel to stay up to date on breaking news coverage

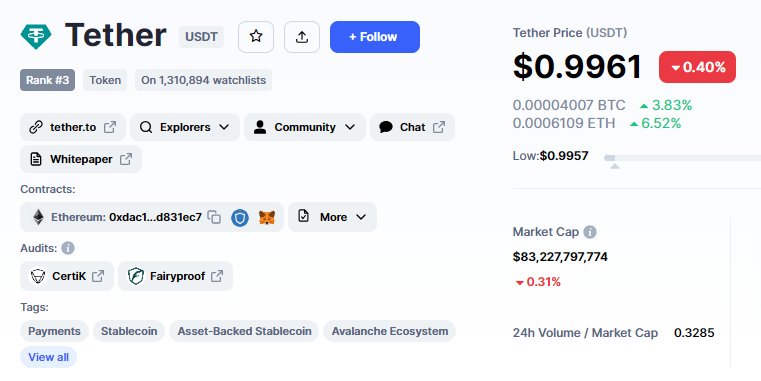

Tether USDT, the popular stablecoin pegged to the US dollar, has recently experienced a depegging phenomenon, causing quite a stir in the cryptocurrency market.

Better safe than sorry: USDT -> USDC.

USDT has depegged by 0.4% and may depeg by even more.

Let’s explore what’s going on 🧵 pic.twitter.com/84v5OwOzeX

— defizard (@belizardd) June 15, 2023

One consequence of the depegging is the overflowing liquidity pools on Curve and Uniswap. These have been flooded with USDT sellers. As a result, USDT briefly traded below its usual parity of $1. The situation is particularly concerning in Curve’s 3Pool, the leading liquidity pool for USDT trading, which has become heavily imbalanced.

$USDT DEPEG🚨😳

👀 USDT Depegs Again As Whales Dump Largest Stablecoin.

Tether wobbles as Curve 3Pool becomes imbalanced🤯

🧵👇🏼👇🏼 pic.twitter.com/rXfxZdqttQ

— Budhil Vyas (@BudhilVyas) June 15, 2023

Currently, the pool comprises $57M worth of DAI, $56M worth of USDC, and a staggering $267M worth of USDT. This means that Tether stablecoin constitutes a significant 70.26% of the pool. It is far from the ideal distribution of 33.3% each for USDT, USDC, and DAI.

Traders are actively offloading their USDT holdings in favor of DAI or USDC. This has caused USDT’s dominance in Curve 3pool to surpass 50%. The last time this happened was during the collapse of FTX exchange in November 2022.

The imbalance in Curve 3Pool had occurred many times in the past, like in March when USDC and DAI’s balances exceeded 45% each. A similar imbalance happened after the crash of the Terra ecosystem in May 2022. This caused USDT to become volatile and temporarily lose its peg.

USDT Depegs -0.4%

Whenever there is an excess of a particular stablecoin in a pool, it can lead to a slight depegging.

Similarly, the increased weightage of Tether stablecoin in Curve’s 3Pool caused its depegging by -0.4% to $0.99578.

This raised concerns among investors and traders who rely on the stability of stablecoins for their transactions and investments.

The price is currently hovering around $0.99801, meaning the stablecoin has recovered almost half its price drop.

Currently, USDT is -0.19% down in 24 hours, with a market cap of $83 billion. The 24-hour Trading volume is $29 billion with 43.24% gains.

Although USDT has occasionally experienced price discrepancies before, it has never sustained a prolonged depeg from its intended value of $1. Therefore, market participants were not panicking and hoped it would rebound.

$USDT depeg actually is not a bad sign that is being portrayed, it has marked the bottom in history!

“History Doesn’t Repeat Itself, but It Often Rhymes”

— Siddharth Singhal (@sidddearth) June 15, 2023

Arbitragers Benefiting from USDT Depegging

Market participants swiftly responded to this de-peg by borrowing a substantial amount of USDT from the decentralized lending platform Aave.

Borrowers took advantage of the devalued Tether stablecoin by selling it for DAI or USDC. These two maintained their standard 1:1 peg with the US dollar.

One interesting case involved an Ethereum address called CZSamSun.eth. The address used collateral consisting of 17,400 ETH and 14,690 stETH to borrow $31.5M USDT from Aave 2. They then exchanged this USDT for 31.47M USDC at $0.997 on Curve. After making deposits amounting to $10 million in V2 and $21 million in V3, the borrower proceeded to take a loan of 12 million USDT from V3 and transferred it to V2.

📖📖

👉 A whale CZSamSun borrowed 31.5M USDT and swapped it for #USDC, causing $USDT to depeg.

👉 Other big whales have started to swap USDC for #USDT, which has resulted in USDT slowly coming back towards its peg.

👉 The #FUD in the crypto… pic.twitter.com/EBYY0Ivk95

— Wise Advice By Sumit Kapoor (@sumitkapoor16) June 15, 2023

Another address, 0xd2, capitalized on the USDT depegging by depositing 52,200 stETH via Aave V2 and borrowing $50M USDC.

This trader strategically swapped large amounts of Tether at a discounted rate using borrowed USDC.

USD Coin was still on its 1:1 peg to the US dollar. They wagered that if USDT eventually returned to its 1:1 peg, they could sell their USDT for a profit.

In response to the sudden surge in demand for USDT loans, Aave’s algorithmic model automatically adjusted its interest rates.

This helped maintain market equilibrium. Consequently, the deposit rate skyrocketed to over 15%, and the borrowing rate surged by more than 25%.

#usdt depeg comes as its supply annual percentage rate (APR) on Aave protocol rose to almost 15% from 2.75% in less than 24 hours.

According to data provided by the lending platform, variable and stable borrowing annual percentage yields (APY) have risen significantly. pic.twitter.com/xfISnhEn3B

— B4CRYPTO (@B4CRYPTOTW) June 15, 2023

The USDT depegging and subsequent events have highlighted the potential risks and opportunities within the stablecoin market. While stablecoins are designed to maintain a steady value, they are not immune to market forces. As demonstrated by the actions of these traders, fluctuations in stablecoin prices can be exploited for profit, especially when there is a temporary depegging.

Tether CTO Remarks on USDT Depegging

Tether’s Chief Technical Officer, Paolo Ardoino, took to Twitter to reassure the crypto community that the de-peg scare is not a cause for concern, emphasizing that they are prepared to redeem any amount of Tether.

Ardoino also shared a “FUD meme” addressing the market rumors surrounding Tether’s depeg.

Markets are edgy in these days, so it’s easy for attackers to capitalize on this general sentiment.But at Tether we’re ready as always. Let them come.We’re ready to redeem any amount.

— Paolo Ardoino 🍐 (@paoloardoino) June 15, 2023

This recent scare of stablecoin depegging comes just a few months after the USDC depegging incident in March 2023, when USD Coin fell below $0.9. Investors’ portfolios took great hits at the time. All these happened after Circle confirmed having over $3 billion stuck with Silicon Valley Bank.

Circle managed to gather sufficient capital to restore the USDC value to the dollar within two days. However, the damage had been done as panic caused many traders to exit USDC at a loss.

Paolo Ardoino, the Tether CTO, expressed that the market is currently tense. He mentioned that recent news and other factors are causing major groups to withdraw from the crypto markets.

Ardoino highlighted Tether’s role as a gateway for incoming and outgoing liquidity. He explained that when interest in crypto grows, they see inflows, but during negative market sentiment, outflows occur. Ardoino also acknowledged the possibility of a direct attack on Tether, citing incidents from 2022.

Read More:

Wall Street Memes – Next Big Crypto

Early Access Presale Live Now

Established Community of Stocks & Crypto Traders

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Best Crypto to Buy Now In Meme Coin Sector

Team Behind OpenSea NFT Collection – Wall St Bulls

Tweets Replied to by Elon Musk

Join Our Telegram channel to stay up to date on breaking news coverage

Comments are closed.