Monthly NFT Metrics Dive Bomb, NFT Sales Measured in USD Slip 16% – Blockchain Bitcoin News

Non-fungible token (NFT) sales have dropped considerably during the last month as cryptocurrency values have seen significant losses in recent times. NFT sales saw a quick spike when a number of crypto assets neared all-time price highs in mid-November, but sales quickly plummeted back down following the crypto market downturn.

A Number of NFT Sales Slide Following Crypto Market Downturn

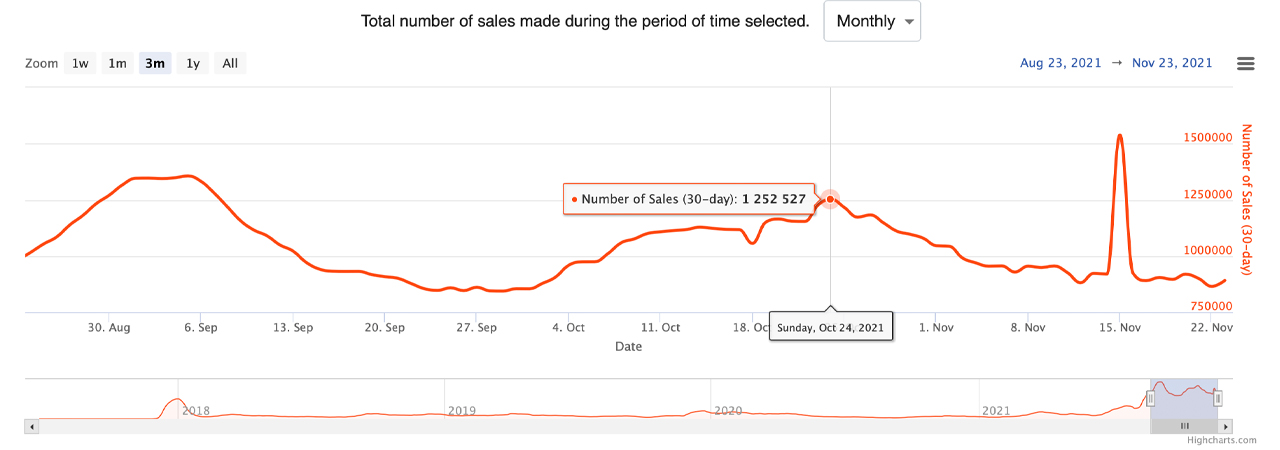

Throughout the year, NFTs have seen massive demand and markets have processed billions of dollars in sales. In the midst of the all-time highs bitcoin, ethereum, and numerous other crypto assets saw in mid-November, NFT sales regained momentum after a downward slump in sales since October 24.

The spike in NFT sales took place on November 15 and lasted only 24 hours. Since the end of October, the number of NFT sales dropped 28.79% according to market metrics from nonfungible.com. Despite the number of NFT sales sliding, the U.S. dollar value of sales stemming from October 24 until today is not such a drastic plunge, only down 16.73%.

The drop over the last 30 days can be seen across popular NFT marketplaces and some of the most popular NFT collections. For instance, during the last month, Opensea sales have dropped 29.22% and the number of traders on Opensea also slid by 15.32%, according to dappradar.com statistics. Two Solana NFT marketplaces saw sales dive bomb this past month as Magic Eden saw sales drop by 11.28%, and Solana Art sales dipped by 68.36%.

NFT marketplaces like Superrare sales are down 33.56% and Rarible lost 20.09% this past month. The NFT platform Foundation saw sales drop by 18.47%, NFT sales on Pancakeswap have slipped 90.61%, and after the Tezos-based marketplace, Hic et nunc returned, sales are down 46.97% in 30 days. The Flow-based NBA Top Shot’s sales have slipped this past month as well and are down 11.33% on Tuesday.

However, not all NFT platforms that allow people to buy and sell digital collectibles have seen sales drop. The blockchain-based game Axie Infinity’s NFT sales are up 41.35% and the number of Axie Infinity traders has jumped 42.94% last month.

The NFT collection Cryptopunks has seen sales rise over the last month gaining 274.35% since October 24. Wax blockchain sales on the Atomicmarket NFT marketplace are up 313.7% in 30 days and the Ethereum-based metaverse world Decentraland’s NFTs sales are up 339.09% this past month.

Meanwhile, specific NFTs are still selling for millions or hundreds of thousands of dollars in crypto depending on the collection. Cryptopunk 9,998 sold this month for $529.77 million at the time of sale, or 124,450 ether. An NFT called “A Coin for the Ferryman” sold for six million dollars or 1,330 ether. Approximately 20 NFTs sold for over $1 million during the last 30 days according to dappradar.com statistics.

Being the most expensive digital asset sold in 30 days, Cryptopunk 9,998 represented a large portion of the $1.8 billion in Ethereum-based NFT sales last month. Although the Cryptopunk 9,998 sale was controversial, and some didn’t consider it a sale at all. The top NFT collections during the last 24 hours include JRNY NFT Club V2, Axie Infinity, Chain Runners NFT, The Sandbox, Wolfgame, and Cryptopunks, respectively.

What do you think about the slump in NFT sales during the last month? Do you think NFT sales are sliding because crypto markets have slipped in value? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, nonfungible.com

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Source link